Gain an Affordable Edge in Real Estate With The Help Of a Skilled Tough Money Lending Institution

In the competitive realm of real estate, the function of a competent hard cash lender can make a substantial distinction in attaining success. The expertise and sponsorship offered by these specialists provide a critical benefit to capitalists wanting to browse the complexities of the marketplace. By comprehending just how difficult money loan providers analyze offers, the versatility they provide in funding choices, and the rate at which they can provide funding, capitalists can position themselves in advance of the competition. Moreover, leveraging a lending institution's experience and market expertise can open up doors to profitable chances that could or else run out reach.

Advantages of Collaborating With a Tough Cash Loan Provider

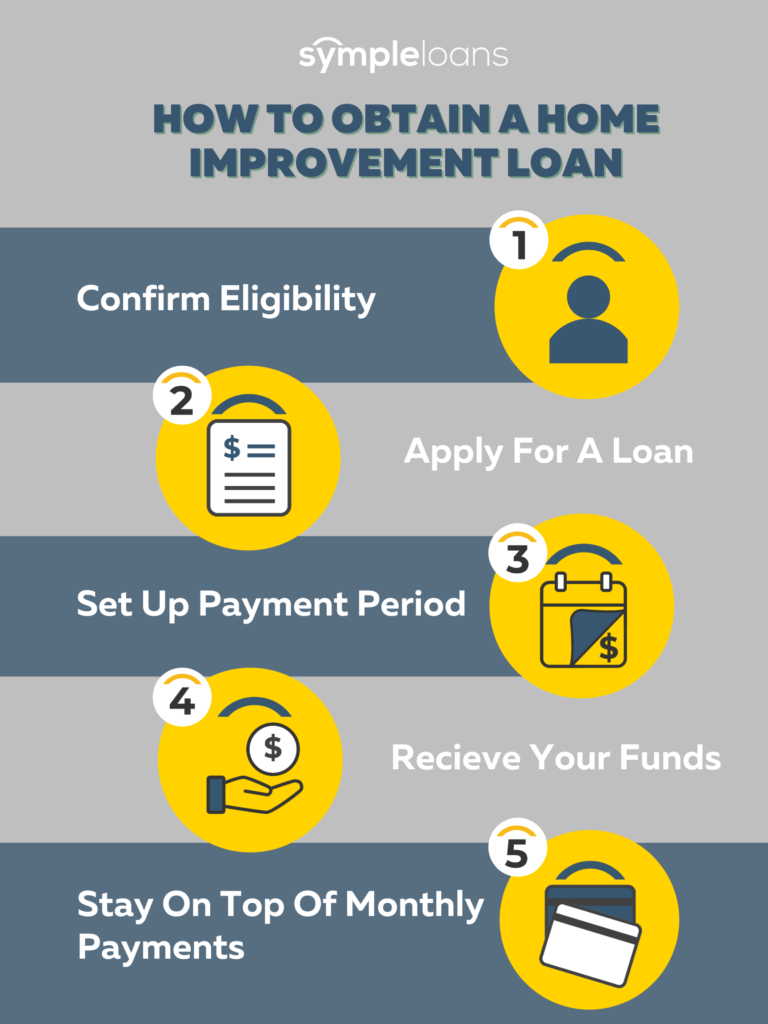

Collaborating with a trustworthy hard cash lending institution can give investor with exceptional speed and flexibility in protecting funding for their jobs. One significant benefit of partnering with a hard cash loan provider is the fast access to capital. Traditional funding options often include prolonged authorization procedures and strict criteria, which can postpone the acquisition of funds. On the other hand, hard money lending institutions focus on quick decision-making, permitting capitalists to take advantage of time-sensitive opportunities in the realty market.

Essentially, the benefits of collaborating with a hard cash lending institution expand past simply monetary aid, providing investors with an affordable edge in the dynamic realty sector.

Just How Difficult Money Lenders Assess Deals

When assessing bargains, tough money lenders carry out thorough assessments of residential or commercial property value, market problems, and customer certifications. Difficult cash lenders usually look at the current market value of the property and its future value after enhancements or improvements.

In addition, tough money lending institutions analyze the borrower's certifications, including their credit report, revenue security, and experience in realty investing. Lenders want to reduce their risk and guarantee that the debtor has the capacity to repay the finance. By meticulously reviewing these key variables, hard cash lending institutions can make informed choices about the viability of a realty deal and deal affordable financing options to financiers.

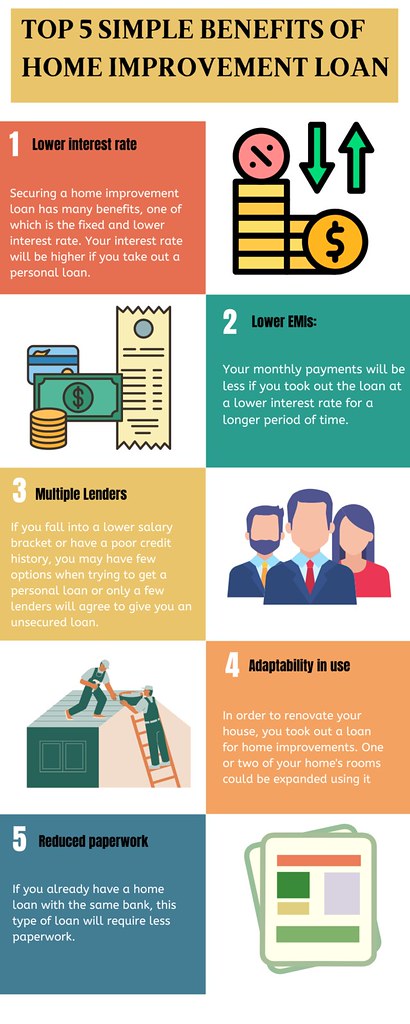

Adaptability in Financing Options

In the middle of the vibrant landscape of genuine estate financial investments, a competent difficult money lending institution offers a spectrum of adaptable financing options tailored to fulfill the varied needs of capitalists. These funding choices offer investors with the dexterity and speed necessary to take advantage of lucrative possibilities in the realty market.

One secret aspect of the adaptability supplied by difficult cash lending institutions is the capacity to tailor loan terms based upon the particular job demands of the investor. Whether it's a fix-and-flip residential property, a new building project, or a lasting investment, tough cash lenders can structure funding services that straighten with the investor's objectives and timeline.

Furthermore, difficult cash loan providers are known for their quick authorization procedures and expedited financing, permitting investors to act promptly in affordable actual estate markets. This speed and effectiveness can be a game-changer when time is of the significance in securing a bargain or completing a job on time.

In significance, the versatility in funding options offered by competent tough money loan providers encourages real estate capitalists to navigate the complexities of the marketplace with confidence and confiscate lucrative chances as they emerge.

Getting Quick Accessibility to Funding

Safeguarding fast access to funding is an essential advantage for genuine estate financiers seeking to profit from time-sensitive possibilities on the market. Having quick access to capital can mean the distinction in between missing out on or taking a rewarding offer out on an important investment chance when it comes to genuine estate deals. Difficult money lenders play an important role in providing this expedited access to funding for capitalists. Unlike standard financing organizations that may have lengthy authorization processes, difficult money lenders can review and approve financings promptly, enabling capitalists to act quickly.

Tough cash lenders comprehend the value of rate in genuine estate transactions and are well-equipped to offer the required funds without delay. By leveraging the services of a competent hard money lending institution, real estate investors can gain a critical edge by accessing funding rapidly and efficiently.

Leveraging a Lender's Knowledge

Attracting upon a loan provider's specialized knowledge can substantially improve a genuine estate capitalist's tactical decision-making procedure. Experienced tough cash loan providers have a deep understanding of the local realty market, existing patterns, and potential threats. By leveraging their proficiency, financiers can get useful insights that might not be conveniently evident, enabling them to make even more educated decisions.

A competent hard cash lender can provide assistance on residential property assessments, potential renovation prices, and market demand, aiding investors accurately assess the earnings of a property financial investment. Additionally, lenders can use advice on the feasibility of a certain job, possible difficulties that might arise, and methods to reduce threats.

Furthermore, difficult cash lenders often have substantial networks in the realty sector, consisting of partnerships with professionals, evaluators, and various other specialists. This network can be leveraged by capitalists to enhance the investment process, gain navigate to these guys access to trusted service companies, and eventually maximize their returns. Fundamentally, teaming up with a knowledgeable hard money lending institution can give investor with an Your Domain Name one-upmanship and enhance their possibilities of success out there.

Final Thought

To conclude, partnering with a proficient tough cash loan provider can offer investor with an one-upmanship by supplying different benefits such as versatile financing alternatives, fast accessibility to funding, and the opportunity to leverage the lending institution's proficiency. By comprehending how tough cash lenders assess bargains and utilizing their sources, investors can enhance their success in the realty market and accomplish their financial objectives better.

Functioning with a reliable hard cash loan provider can offer actual estate capitalists with unmatched rate and adaptability in protecting financing for their tasks. In contrast, tough money lenders specialize in fast decision-making, permitting financiers to exploit on time-sensitive chances in the genuine estate market.

By meticulously examining these key aspects, tough money lending institutions can make informed decisions about the stability of a genuine estate bargain and deal affordable funding choices to capitalists.

By leveraging the services of a knowledgeable difficult cash lending institution, real estate capitalists can acquire view publisher site a critical edge by accessing funding promptly and effectively.

In essence, working together with a knowledgeable hard money lending institution can provide genuine estate financiers with an affordable edge and boost their opportunities of success in the market.